Often I find my clients focusing on only one aspect of money: their dissatisfaction of how much money they make. For example, one of my clients, a successful couple who make together around $150,000 a year (a significant amount to most) and yet they were feeling like this was not enough and they still needed to make more money. One of the reasons they felt they needed more money was because they had two children and the oldest had just started college. In addition, the second child was starting college the next year. They were in a bit of shock about all the unexpected costs. On top of the financial pressure they felt from college expenses, they had not seen any raises for several years because of the downturn in the economy. They were feeling a lot of financial stress and they could think of only one way out, which was to increase their paychecks. The husband had applied for a new position that would provide the increase in pay they both thought would solve all of their money issues. When the couple came to me for their regular financial review, I asked them what they thought this new job was going to cost them? They paused for a moment and said, "Probably just a few more hours of working time a week." I then asked if they had ever gone through an exercise that would calculate what those few more hours a week would really cost them. I further explained that it costs money to work, and sometimes it’s a lot more than just your time. So, it’s important to know your REAL hourly wage not what your paycheck says, not the one you think you’re worth... you want to know the real return on your investment of time. They both agreed they had never really looked at their pay this way and were willing to run through the exercise of calculating the "REAL Hourly Wage." The formula I use with my clients is the following: [Your Real Hourly Wage] = [Your Adjusted Income] ÷ [Your Adjusted Job Hours]

What You Need To Calculate Your REAL Hourly Rate

- Work-Related Benefits: Jobs often offer many benefits to employees. As part of the real hourly wage calculation, you need to include as income the value of the benefits you receive. You can make your calculation based on an average month or an average year. With certain benefits, it may be easier to do these calculations based on annual amounts.

- Work-Related Expenses: Jobs also have costs to employees. Some of these are obvious, such as commuting costs. Others are not so obvious (gas or transit fares, income taxes, work clothes, and others). We’re not dealing here with the intangibles of wrecked relationships or neglected house maintenance; we’re only counting what is measurable.

- Work-Related Time: Your time is valuable and your work-related time is more then just the time spent at work. How much time are you spending on job-related activities? For example, time spent commuting, shopping for work clothes, time working in off hours at home, time thinking about work, and doing research. You can calculate this on a weekly, monthly, or annual basis.

- Your Adjusted Income: This is calculated by taking your current wages or salary and adding the value you came up with for your work-related benefits, then subtracting your work-related expenses. [Wages] + [Work-Related Benefits]

- Your Adjusted Job Hours: This is calculated by the actual amount of time you spend “on the job” and then adding the time you calculated for time spent on work-related activities. [On-The-Job Time] + [Work-Related Time]

Your REAL Hourly Rate

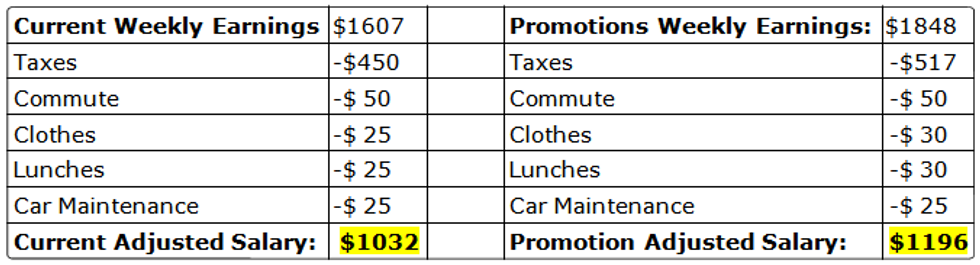

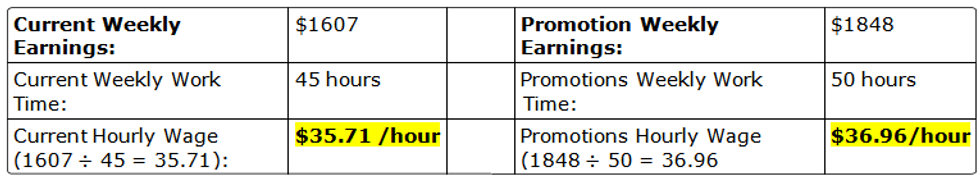

Here’s what my clients came up with: The husband's current salary was $90,000 a year and with the promotion his salary would be $103,500 and he was currently working about 45 hours a week and in his new position he estimated his hours would go up to about 60 hour a weeks.BUT...

We still needed to adjust for his job-related expenses by subtracting them from his weekly salary.

AND...

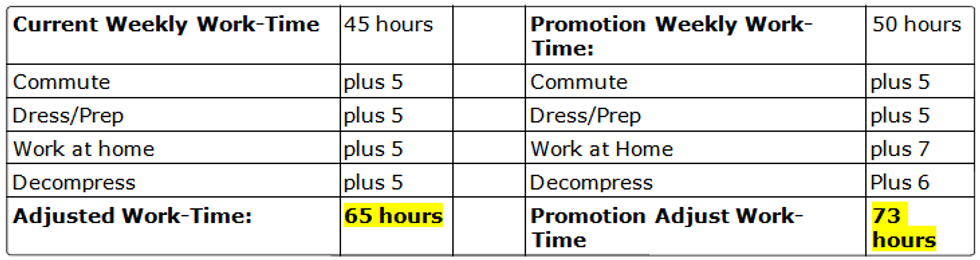

His Job-related activities beyond his regular hours on the job had to be added to his work time.

The REAL Hourly Wage

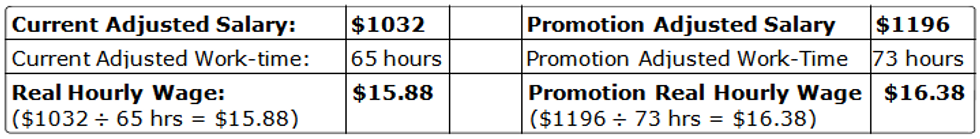

We finally arrived at his REAL Hourly Wage of $16.38/hour for the promotion job and they were surprised to discover that this was about the same as what he was currently making.

Not the $1848 ÷ 50 = $36.96/hour, but... $1196 ÷ 73 hours = $16.38/hour

They could now see his nominal salary and REAL hourly wage were quite different. He could also say he traded an hour of life energy for about $16.38 and every dollar he spends can be represented by 3.7 minutes of his life energy.

As you can see in this couples life you need a definition of money that focuses on more then one aspect, and that has a personal useful relevance in your life. Just WHAT is the nature of the exchange you are making?

We finally arrived at his REAL Hourly Wage of $16.38/hour for the promotion job and they were surprised to discover that this was about the same as what he was currently making.

Not the $1848 ÷ 50 = $36.96/hour, but... $1196 ÷ 73 hours = $16.38/hour

They could now see his nominal salary and REAL hourly wage were quite different. He could also say he traded an hour of life energy for about $16.38 and every dollar he spends can be represented by 3.7 minutes of his life energy.

As you can see in this couples life you need a definition of money that focuses on more then one aspect, and that has a personal useful relevance in your life. Just WHAT is the nature of the exchange you are making?

Consider These Ideas:

- We spend our life energy in hours on the job in exchange for money.

- We support someone else (who earns money) with our life energy, thereby allowing money to come into our life.

- We spend our life energy managing our investments, in exchange for increased dividends or value.

- No matter how we acquire money, we spend some amount of time (life energy) to get it.

- The amount of life energy may not be the same in every instance, but it is universally true that life energy was traded for money.

- Money = something we trade our life energy for.

- Every dollar you spend is equal to the amount of your life energy it took to get it.

- An hour of your life is precious, because it’s limited. Once it’s gone you can never get it back.

- When you spend money you are spending your life energy, your time.

Bigstock

Bigstock Bigstock

Bigstock Bigstock

Bigstock